Quick Summary: MotoAssure Reviews: You Need to Know Their Claims Process

- Content Type: Overview

- Last Updated: July 21, 2025

- Fact-Checked By: No One

- Best For: Owners of older, high-mileage cars who are looking for the absolute cheapest coverage option.

- What’s Great: It offers very affordable plans with valuable perks like day-one rental car coverage and roadside assistance.

- What’s Not: A poor D+ BBB rating reflects a high number of complaints about frustrating and often-denied claims.

- Buy If: You prioritize saving money above all else and are willing to risk a potentially difficult claims process.

- Avoid If: You want guaranteed peace of mind and a reliable, hassle-free claims experience from a top-rated company.

- Affiliate Link Present: No

Customers are mixed about MotoAssure. Some love the broad coverage because it saves them money on expensive repairs. Others share stories about long wait times for claim approval or having their repair claims denied. Given MotoAssure’s D+ BBB rating we have to ask why. When we dug deeper we found MotoAssure sells vehicle service contracts that cover unexpected mechanical breakdowns. But they haven’t addressed many of the complaints filed against them which makes us question their customer support. MotoAssure reviews of their warranty plans are mixed. Some like the lower cost but others struggle with filing claims. After reading many customer reviews we’re breaking down what you need to know before you buy a plan in 2025.

MotoAssure Vehicle Protection Plans

MotoAssure has plans that are different from other vehicle service contracts. They have multiple levels of coverage to fit different needs and price points. I found these plans go beyond standard manufacturer warranties. They have options based on a vehicle’s age, miles and condition.

Coverage Options: Powertrain to Full Coverage

MotoAssure breaks down their protection plans into three simple levels.

- Platinum Plan: This is their most comprehensive plan and acts like a true bumper to bumper warranty. It covers all parts and systems in your vehicle. Engine, transmission, suspension, electrical parts and even automatic windows are all covered. This plan is an exclusionary agreement so everything is covered unless it’s listed as not covered.

- Gold Plan: The Gold Plan is in the middle tier and offers good but more specific coverage. It covers listed systems like drivetrain, fuel system, steering and air conditioning. Unlike the Platinum Plan, parts not listed in the contract are not covered. Powertrain Plan: The standard option includes key parts that generate and send power to the wheels. This means engine, transmission, transfer case, driveshaft, differential and axle are part of the coverage.

MotoAssure also provides a Pre-Paid Maintenance Plan to handle the costs of regular vehicle services.

Repair Network and Service Availability Across the Country

An important feature of MotoAssure plans is access to a wide network of certified repair shops all over the United States. This broad coverage helps drivers locate a trusted mechanic no matter where their car breaks down. This network brings great convenience to people who travel often or stay in less accessible areas.

Roadside Help and Rental Car Perks

Unlike its rivals, MotoAssure includes rental car coverage starting on day one with all its plans. You get rental help no matter how long the repair takes even if it is just a quick two-hour fix. This support offers up to $50 per day for five days and a total of $250 for each occurrence.

MotoAssure’s round-the-clock roadside assistance offers several services:

- Free towing within 25 miles

- Jump-starting your battery

- Fuel delivery (you pay for the gas itself)

- Help when locked out of your car

If your car breaks down over 100 miles from home, MotoAssure offers trip interruption coverage. They provide $75 a day for meals and lodging up to $225 for three days in total.

Every plan includes liability limits of $12,500 or the current cash value of your car at the time of repair—whichever amount is higher. This means they will cover qualifying repairs up to $12,500 even if your car’s actual worth is just $5,000.

MotoAssure Costs and Value Assessment

Pricing plays a key role when deciding on a vehicle protection plan. When I looked into MotoAssure, I saw that their pricing structure combines broad coverage with flexible payment methods designed to fit different financial situations.

Typical Costs of Plans and Payment Flexibility

MotoAssure protection plans cost between $1,500 and $4,000 for coverage lasting multiple years. To make payments easier monthly plans are available and range from $70 to $150. Some plans might also have setup fees in the beginning. What stands out most is MotoAssure’s new month-to-month payment option. This lets customers keep their coverage without signing lengthy agreements. It gives a break from standard warranties that often require long-term contracts.

What Can Change the Price of Your Plan?

A few important factors decide how much your MotoAssure plan will cost:

- Type of vehicle, its model, and how old it is

- Mileage when enrolled

- Chosen coverage type (Platinum, Gold, or Powertrain)

- Selected deductible amount

High-mileage cars come with increased premiums. However, MotoAssure claims to offer fair pricing for older cars positioning itself as a balance between affordability and manufacturer-backed extended warranties. The company highlights clear pricing with no surprise charges.

Should You Pay Upfront?

Some customers think the initial cost seems high, but many say they save a lot after using the plan for claims. Kyle R., a customer, shared his experience: “It felt expensive at first, but then my transmission went out and the plan saved me thousands.” Another reviewer, Robert D., mentioned: “The plan was a bit pricey upfront, but considering how much car repairs cost, it’s a good investment.”

The costs stand out when you look at typical repair expenses. Swapping out a transmission runs about $3,910, while replacing an engine averages close to $7,349. One big repair like that can cover multiple years’ worth of protection plan fees. Whether a MotoAssure plan is worth it depends a lot on how often your car needs repairs, the shape it’s in, and how you tend to drive.

Claims in 2025: What Are Customers Saying?

Customer reviews reveal what a warranty provider is like. After reading through hundreds of MotoAssure reviews from January 2024 to April 2025 clear patterns show up about the way claims get managed.

Success Stories in MotoAssure Reviews

Many MotoAssure reviews talk about great experiences. People love the peace of mind their extended warranties bring. The 24/7 roadside help and rental car options get rave reviews. One commuter from Phoenix told us about their alternator issue. They got a tow truck in 8 minutes and the shop was paid within a day.

Some of the most common positive stories mention:

- Full transmission fixes with the rental car covered

- Engine repairs that saved people a lot of money

- Claims processed without any hassle

Sarah K. said, “My claim was processed and done without hassle.”

MotoAssure Admin Reviews: Delays and Denied Claims

MotoAssure admin reviews show repeated complaints. Many customers get denied claims because their situation falls under contract exclusions. The biggest gripe is the “pre-existing conditions” clause. This applies for 30 days after purchase and can deny claims if breakdowns happen in that time frame.

Some other common issues are:

- Long wait times for customer service

- Trouble getting ahold of support during busy times

- Shops need adjuster approval before they can start work, which slows down repairs

Michael H. said, “The call about my claim status took longer than I wanted.”

Overview of Complaints About MotoAssure Admin BBB

Sources give mixed details about the MotoAssure BBB status. One says they have an A- rating and a 4.35-star average from 31 reviews. Another points out they could have a “D” or “F” rating, depending on the area.

The main complaints include: Over 100 grievances in the last three years, claims of misleading ads and claims being rejected, and refund and cancellation problems. These issues, as reported to the MotoAssure Admin BBB, create a lot of debate about how well they handle claims.

Even though their BBB profile claims the company aims to deliver great customer service and approve claims, customers’ feedback often tells a different story. This difference between what MotoAssure says and how customers feel creates a lot of debate about how well they handle claims.

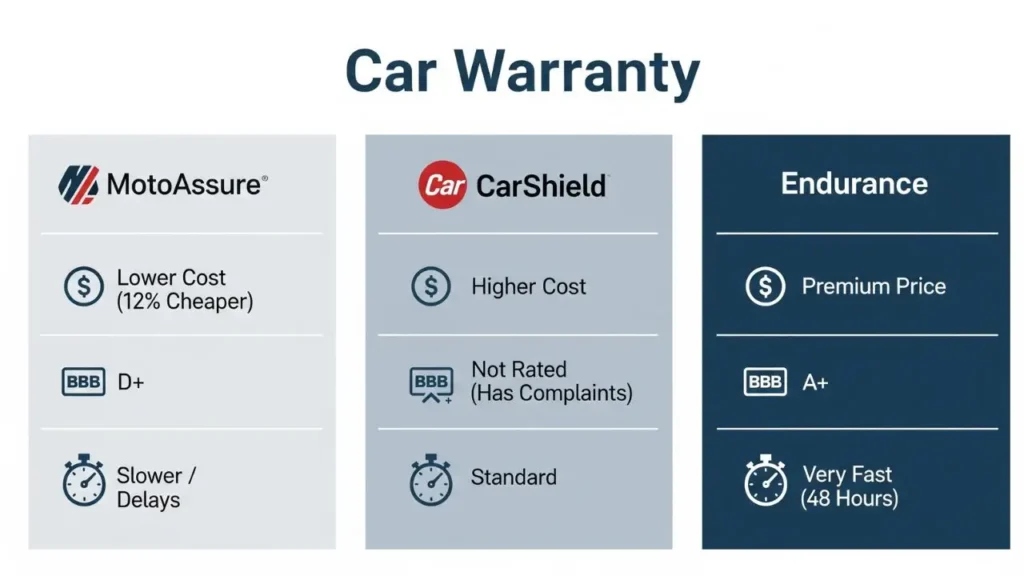

MotoAssure vs Competitors: A Comparison

MotoAssure vs CarShield

Sign-Up Process: MotoAssure avoids robocalls and requires sign-up via website or dealership, while CarShield has faced complaints over aggressive telemarketing.

FTC Settlement: CarShield paid $10 million to the FTC over misleading advertising practices.

Cost Comparison: MotoAssure plans are around 12% cheaper than CarShield’s similar offerings.

Coverage Options: CarShield offers eight plan levels, compared to MotoAssure’s three.

MotoAssure vs Endurance

BBB Rating: BBB Rating: Endurance has an A+ rating and has been accredited since 2009; MotoAssure BBB holds a D+ rating.

Claims Processing: Endurance processes claims in 48 hours. MotoAssure has slower response times.

Administration: Endurance acts as a direct administrator (no middlemen), unlike MotoAssure.

High Mileage Plans: MotoAssure is often cheaper for older or high-mileage vehicles.

MotoAssure vs Olive

Business Model: Olive is a broker, not a provider. It sells mechanical breakdown insurance under three fixed plan tiers.

Pricing: Olive’s monthly costs range from $23 to $141 based on vehicle age and plan level. For a 5-year-old luxury sedan, Olive’s top-tier plan is about $107/month.

Flexibility: MotoAssure offers more flexible contracts compared to Olive’s tiered structure.

Cost Advantage: MotoAssure is typically more affordable than Olive for comparable coverage.

Which Plan Gives Better Claims Assistance?

Industry reports show Endurance stands out with its quick claims process approving claims in just 48 hours. Carchex also performs well in managing claims . On the other hand, MotoAssure struggles in this area, as reflected by many BBB complaints about denied claims. Choosing the right provider depends on your car’s needs how much you’re willing to spend, and how much risk you’re comfortable with.

Conclusion

Looking into MotoAssure’s plans and customer feedback tells a mixed story. MotoAssure scores points for affordable pricing and wide coverage which attracts car owners who want to save money. Its repair network is nationwide and it offers nice extras like roadside assistance and rental car perks. It all sounds good but there are trade-offs to consider.

The big gap between good experiences and bad claims can’t be ignored. Some say repairs saved them a lot of money. Others complain about denials and delays which ruins the idea of having coverage in the first place. These mixed results makes you wonder how reliable the service is when you need it.

MotoAssure generally has cheaper plans than top competitors especially if your car has a lot of miles on it. But their D+ rating with the MotoAssure BBB doesn’t look good next to rivals like Endurance, which has an A+ rating and faster claims processing. So whether you go with them or not depends on how much risk you’re okay with and how much money you can spend. The concerns raised with the MotoAssure Admin BBB should be a key part of your decision-making.

From going through hundreds of customer MotoAssure reviews, I suggest looking at MotoAssure if you own an older car with a lot of miles, want affordable coverage, understand your contract , and can handle claims that might be tricky. But if you want claims to run and without hassle, premium providers might be worth it even though they cost more.

MotoAssure has its ups and downs. Their plans can save you money by covering unexpected costs, but getting claims approved seems harder compared to what top-rated companies offer. Make sure to read your contract before buying, know all the exclusions, and decide if saving costs is worth dealing with some added uncertainty in the claims process.

Main Points

After looking at hundreds of MotoAssure reviews and stacking them up against rivals here’s what you should know before buying a plan in 2025:

• Hit-or-Miss Claims Handling: Some folks save thousands on big repairs, but others deal with delays or denied claims. Coverage reliability seems to vary when it’s needed most.

• Affordable Plans Come with Risks: MotoAssure costs about 12% less than competitors like CarShield. However, with their D+ rating from the BBB, issues with claims processing might be a concern.

• Wide Range of Coverage Choices: They provide a three-tier system, from basic powertrain to full bumper-to-bumper protection. Plans include handy perks like rental car coverage starting day one and access to repairs across the country.

• Best Choice for High-Mileage Cars: Works well with older vehicles that have logged many miles—ideal for owners willing to trade some claim reliability to save big on costs.

• Pay Attention to Details: Outcomes rely a lot on knowing what the contract excludes and understanding rules about pre-existing conditions. These can lead to claims being denied in the first month.

The takeaway: When claims are approved, MotoAssure gives real financial relief. However, getting to that point seems tougher compared to pricier options. Think about how much risk you’re ready to handle before deciding.

FAQs

Q1. How is MotoAssure different from regular extended warranties? MotoAssure has flexible plans for high-mileage cars and various brands. It covers areas that many standard extended warranties might not include.

Q2. What is the claims process with MotoAssure like? MotoAssure tries to make the claims process simple with clear steps about filing needed papers, and how long it might take. Still, some users have mentioned facing delays or issues while filing claims.

Q3. How does MotoAssure’s pricing compare to competitors? MotoAssure has cheaper plans particularly for vehicles with high mileage. Their prices are around 12% lower than similar plans from options like CarShield.

Q4. What types of coverage does MotoAssure offer? MotoAssure offers three main levels of coverage: Platinum, which covers everything; Gold, which focuses on broad but specific areas; and Powertrain. They also include extras like rental car coverage and roadside help.

Q5. Is MotoAssure worth the investment? MotoAssure can be valuable depending on your needs. Some users say it saves them a lot on big repairs, while others deal with denied claims. It works best for people with older cars or high-mileage vehicles who are willing to accept some risk with claims to save money.